Leisure sector growth: It’s getting harder out there

With a slew of weaker-than-expected US macro data coming out yesterday for March (Durable goods orders up 0.8% month-on-month from a steep drop in February; capital goods orders flat; consumer confidence slipping from 96.1 to 94.2), it might be a good time to contrast stock market optimism with the reality of underwhelming corporate data.

Optimism despite the evidence…

Company results are failing to match the recent stock market strength. Quality profit-makers and genuine growth stories rightly command a premium valuation.

Meanwhile, the FTSE 100’s appreciation to over 25x PE (thanks largely to oil and miners) looks a little heady.

It contrasts with what Langton is hearing anecdotally from boots on the ground, anyway.

Premium for delivery

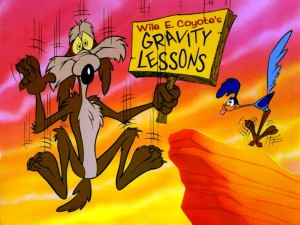

The hotel sectors here, in London (but not yet the regions), and in the US are increasingly looking like Wile E. Coyote running on thin air, as they paper over faltering occupancy numbers by ramping up average daily rates in order to sustain RevPAR growth.

Whitbread has acknowledged this trend and believes it is set to continue.

As for eating out, Restaurant Group, M&B, and Whitbread have all come unstuck to varying extents in their increasingly searching quest for organic growth. These incumbent Leisure operators are also fending off the now not-so-new market entrants, who continue to nip at their market share.

Evolution the only constant

Rents and labour costs are getting pushed up and MDs are muttering about a shortage of quality chefs. All the while new concepts with new, often hybrid, cuisines continue to announce themselves to the industry.

Enterprise Inns and Punch Taverns are forging new identities in anticipation of a post-Market Rent Only pub industry, although they both trade at such substantial discounts to net assets that there must be more upside than down.

Varying mixtures of quality, growth, and value can still be found in the Leisure market in the likes of Punch and Marstons, for example, although the investment case for the wider market is getting harder.